Corporate Governance

Basic ideas

Basic Approach to corporate governance

Tokai Carbon recognizes that enhancing medium to long-term corporate

value is the most important management objective. We believe that responding to the expectations

of all stakeholders, including customers and shareholders, and building favorable relationships,

is essential in achieving this objective. To this end, we embrace the corporate philosophy of

Strength in Trust.

Through this philosophy and through the policies and values outlined in our Guidelines and

Global Code of Conduct, we are working to develop an effective corporate governance structure.

Structure

Corporate governance system

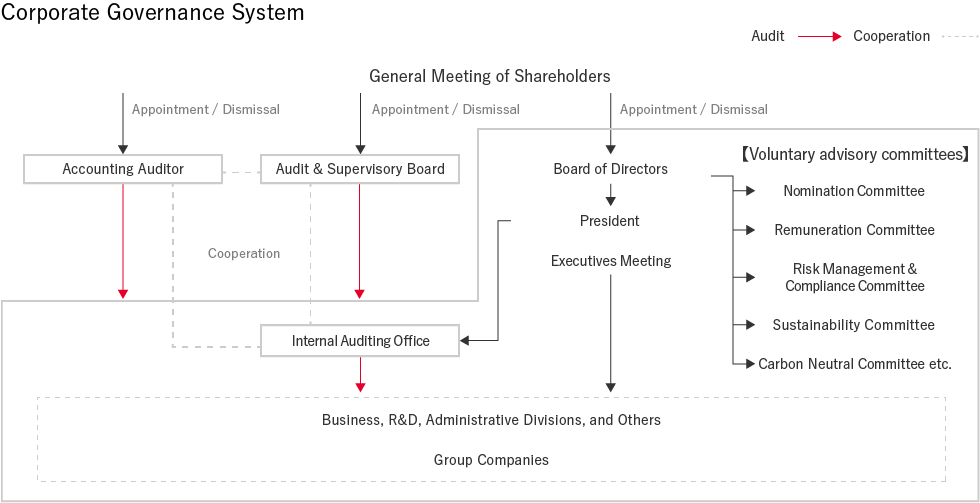

As a company with an Audit & Supervisory Board, Tokai Carbon focuses on enhancing the effectiveness of audits by Audit & Supervisory Board members and our internal audit functions. At the same time, we work to strengthen the management supervision functions of the Board of Directors by appointing multiple external directors and establishing voluntary committees in order to realize an appropriate corporate governance structure. Furthermore, to clarify the functions and responsibilities of corporate officers engaged in business execution, we have adopted an executive officer system and established a Managing Executives Meeting to enhance and strengthen the business execution functions of the organization.

Scroll horizontally to view the whole table

Board of Directors

The Board of Directors is responsible for making decisions on important

management matters and overseeing business execution. In principle, the Board meets monthly. As

of May 1, 2025, the Board of Directors consists of eight members (two of whom are external

directors*). The Nomination Committee and Compensation Committee, for which the majority of

members are external directors, have been created as voluntary advisory committees for the Board

of Directors. The Risk Management & Compliance Committee and Sustainability Committee also a

voluntary advisory committees, has been established immediately under the Board of

Directors.

* Until FY2024, we maintained a board composition where independent external directors

accounted for at least a third of all directors, with 3 independent directors and 6 internal

directors. However, as a result of one independent external director passing away during

FY2025, we currently do not satisfy the said structure. We are now diligently working

towards ensuring that independent external directors comprise at least one-third of the

board in preparation for the Annual Shareholders’ Meeting scheduled for March 2026.

【Voluntary advisory committees of the Board of Directors and their roles】

| Committee | Role |

|---|---|

| Nominating Committee | To deliberate and refer the following to the Board of Directors Meeting:

・Contents of bill related to the election of director candidates and dismissal of directors to be submitted to the Shareholders Meeting. ・Election and dismissal of representative director(s) and the president. ・Election and dismissal of executive officers. ・Election and dismissal of executive officers with titles. ・Others, judged to be necessary regarding personnel of directors and executive officers. |

| Remuneration Committee | To deliberate and refer the following to the Board of Directors Meeting:

・Establishment of basic policy, rules, systems, etc., regarding remuneration, etc., of directors and executive officers. ・Contents of bill related to cap amount of remuneration of directors to be submitted to the Shareholders Meeting. ・Others, judged to be necessary regarding remuneration, etc., of directors and executive officers. ・Deliberate and determine the contents of individual evaluation and amount of remuneration of directors and executive officers mandated by the Board of Directors Meeting. |

| Risk Management & Compliance Committee | Deliberate important matters pertaining to risk and compliance and provide advice to related departments and offices based on its results as well as providing reports and advice to the Board of Directors Meeting. |

| Sustainability Committee | Deliberate important matters pertaining to sustainability and provide advice to related departments and offices based on its results as well as providing reports and advice to the Board of Directors Meeting. |

Audit & Supervisory Board members and the Audit & Supervisory Board

As a general rule, the Audit & Supervisory Board of the Company meets monthly. As of March 27, 2025, there are four Audit & Supervisory Board members, of whom two are External Audit & Supervisory Board members. Audit & Supervisory Board members perform audits based on the auditing policies and audit plan adopted by the Audit & Supervisory Board. Audit & Supervisory Board members attend Board of Directorsʼ meetings and other important meetings, and investigate the status of business operations and assets to confirm the status of business execution by directors.

Management Committee

The Company has established the Management Committee chaired by the President and CEO. This committee deliberates and makes decisions on important management matters in accordance with basic policies adopted by the Board of Directors. The Management Committee meets once a week, in principle, with participation by executive officers and Audit & Supervisory Board members, etc. To assist the Management Committee with its work, we have also established committees to deliberate particular types of matters and report their findings to the Management Committee for higher-level consideration.

Initiatives

Strengthening the Effectiveness of the Board of Directors

In 2016, Tokai Carbon established the Nomination Committee, Remuneration

Committee, Management Committee, and Risk Management & Compliance Committee to ensure strong

governance led by the Board of Directors. As a result, significant improvements were noted on

various fronts. These improvements became apparent in the annual

Board of Directors effectiveness evaluation.

At Tokai Carbon, all external directors not only attend all meetings of the Board of Directors,

but also actively attend important meetings other than meetings of the Board of Directors to

deepen their understanding of significant subjects. It has been pointed out that the impartial

and objective comments of these external directors have contributed significantly to enhancing

our functions for monitoring the Board of Directors.

This was the ninth evaluation. It was evaluated that not only has the current governance system

taken hold and its initial outcome been appropriately maintained, but in 2024 certain progress

was also seen in relation to the link between sustainability and management, such as

biodiversity measures, and “action to implement management that is conscious of the cost of

capital and stock price.”

In terms of issues for the future, we will continue to work on higher-level themes such as the

link between sustainability (including measures for carbon neutrality) and management strategy

and enhancing business portfolio management.

“Details of the 2024 Board of Directors Effectiveness Evaluation”(PDF:

49KB)

Establishing an internal control system

To ensure that Tokai Carbon Group properly executes business operations in accordance with relevant laws, regulations and the Articles of Incorporation, the Company continuously improves its internal control system. Improvements are undertaken in accordance with the “Basic Policy for Establishing an Internal Control System,” which was adopted at the May 2006 meeting of the Board of Directors and is revised as necessary.

Management Appointment Process

The appointment of Directors, Audit & Supervisory Board Members, and

Executive Officers begins with the formulation of recommendations by the Nomination Committee,

which is an advisory committee to the Board of Directors and consists of one internal board

member

three external board members. The Nomination Committee prepares its recommendations by

comprehensively considering the experience, knowledge, expertise, and other qualities of

internal and external candidates. After approval by the Board of Directors, candidates for

Director and Audit & Supervisory Board positions are submitted to the General Meeting of

Shareholders for approval.

The Company discloses the reasons for nominating internal and external candidates for Director

and Audit & Supervisory Board positions in reference materials provided for the General Meeting

of Shareholders. To see an example, please refer to pages 4 to 16 of the Notice of FY2024

Annual

Meeting of Shareholders.

“Notice of FY2024 Annual Meeting of Shareholders”(PDF: 98KB)

Executive remuneration

■Basic policy on executive remuneration

| Directors and Executive Officers (excluding external directors) | Policy for the determination of remuneration for directors and executive

officers is a matter for resolution by the Board of Directors. Amounts are

set in line with the Company’s performance and with individual performance

and achievements, within the remuneration limit approved at General Meeting

of Shareholders. The goal is to ensure that the officers responsible for the

execution of business have a strong commitment to the achievement of high

management targets and the maximization of medium- to long-term corporate

value, while ensuring a standard that meets the following requirements.

・Remuneration to encourage officers’ commitment to short-, medium-, and long-term management targets ・Remuneration at a level that motivates current and future officer candidates and is not inferior to the level of competitors ・Remuneration with the guarantee of transparency and rationality to ensure accountability toward officers, shareholders, and investors |

|---|---|

| External directors, Audit & Supervisory Board members | Basic remuneration only |

■Executive remuneration system overview

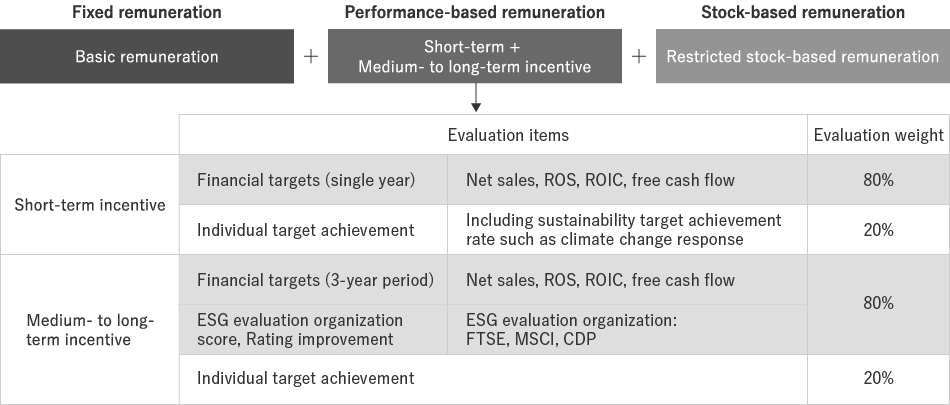

Tokai Carbon’s executive remuneration consists of a fixed “basic remuneration”, variable“performance-linked remuneration” and “stock-based remuneration”, which fluctuate based on the achievement of performance targets. For directors and executive officers responsible for business execution, the proportion of “performance-linked remuneration” to “basic remuneration” increases with seniority, reflecting their level of responsibility and impact on our Company’s performance. To ensure independence in determining individual compensation, the Board of Directors delegates this decision to the Remuneration Committee, where external directors constitute the majority. The Remuneration Committee conducts multi-faceted reviews, including alignment with the remuneration policy, ensuring that the Board of Directors deems the remuneration content to be appropriately determined. Remuneration for Audit & Supervisory Board members is determined through deliberations by themselves, within the remuneration limit approved at General Meeting of Shareholders.

【Basic remuneration】

To be determined by reflecting the assessment in the reference amount in line with the title position.

【Performance-based remuneration】

Performance-based remuneration consists of short-term incentive remuneration and medium- to

long-term remuneration.

For the short-term incentive remuneration, a reference amount is determined in accordance with

the title position, and the amount to be paid will be determined within the range of 10% to 200%

of the reference amount in accordance with financial target index and individual target

achievements (including sustainability target).

For medium- to long-term incentive remuneration, a reference amount is determined in accordance

with the title position, and the amount to be paid will be determined within the range of 10% to

200% of the reference amount in accordance with financial target index, ESG evaluation

organization score, degree of rating improvement, and individual target achievements.

Indices prioritized in the medium-term management plan will be used for the financial target

index.

Only the basic remuneration shall be provided to non-business operating directors and auditors

that are independent of business execution, as performance-linked remuneration is not

appropriate.

【Stock-based remuneration】

With the aim of providing an incentive to continuously improve corporate value and to promote the sharing of value with the shareholders, remuneration to provide shares with a restriction on transfer is provided as a monetary claim within an annual amount of 100 million yen to directors excluding external directors. The period of restriction on transfer shall be 30 years from the day of allotment and the transfer restriction shall be lifted by the resolution of the Board of Directors upon expiry of the restriction period, expiration of the term of office, or resignation by death or other just reasons. Depending on the individual’s contribution to performance, a maximum of 15% of the total amount of basic and performance-based remuneration will be determined for stock-based remuneration.

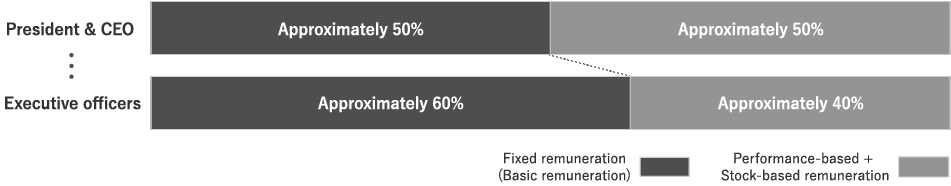

■Remuneration structure

■Composition ratio of remuneration (based on standard remuneration)

As for the system regarding composition ratio of remuneration by title,

the ratio of the President’s performance, etc.-based remuneration (“performance-based and

stock-based remuneration” in this case, approximately 50%), shall be the highest-ranked, and the

ratio of performance, etc.-based remuneration will decrease in order of the title towards

executive officer (approximately 40%).

■Total amount of remuneration for Directors and Auditors for FY2024

Scroll horizontally to view the whole table

| Director classification | Total amount of remuneration, etc.(million yen) |

Total amount by remuneration type (million yen) | Number of subject directors | |||

|---|---|---|---|---|---|---|

| Basic remuneration | Performance-based remuneration | Non-monetary remuneration | ||||

| Bonus | Transfer restricted stock remuneration | |||||

| Director (excl. external directors) | 234 | 102 | 100 | 31 | 6 | |

| Auditor (excl, external auditors) | 36 | 36 | - | - | 3 | |

| External officers | External director | 39 | 39 | - | - | 3 |

| External auditor | 14 | 14 | - | - | 2 | |

| Total | 325 | 193 | 100 | 31 | 14 | |

※1The annual amount of director remuneration is capped at 350 million yen or less (for 13 directors or less) resolved at the General Shareholders Meeting for FY2005, held on March 30, 2006.

※2Remuneration by the transfer of restricted shares is capped at 100 million yen or less, with annual amount limited to 100,000 shares resolved in the General Shareholders Meeting for FY2019, held on March 27, 2020. The number of directors as of the closing of the said General Shareholders Meeting (excluding external directors) was 6.

※3The annual amount of auditor remuneration is capped at 65 million yen or less (for 4 auditors or less) resolved at the General Shareholders Meeting for FY2005, held on March 30, 2006.

※4The number of directors as of the closing of the current fiscal year was 8 directors (of which 3 are external directors) and 4 auditors (of which, 2 are external auditors).