Mid-Term Management Plan

1. Background of T-2018 – Summary of the Previous Mid-Term Management Plan T-2015 –

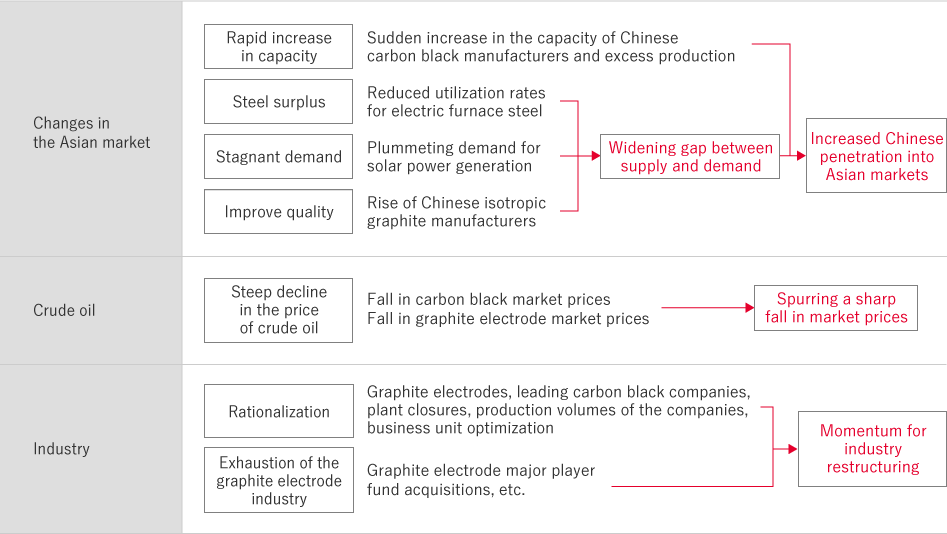

Changes of Market Condition

Scroll horizontally to view the whole table

Tokai Carbon has faced the following issues:

We have learned valuable lessons from T-2015. In the new Mid-Term Management Plan T-2018, we will be implementing comprehensive structural reform based on business restructuring and changing the company’s mindset to rebuild the foundation of our business in a return to our first principles.

2. Mid-Term Management Plan T-2018 Basic Policies

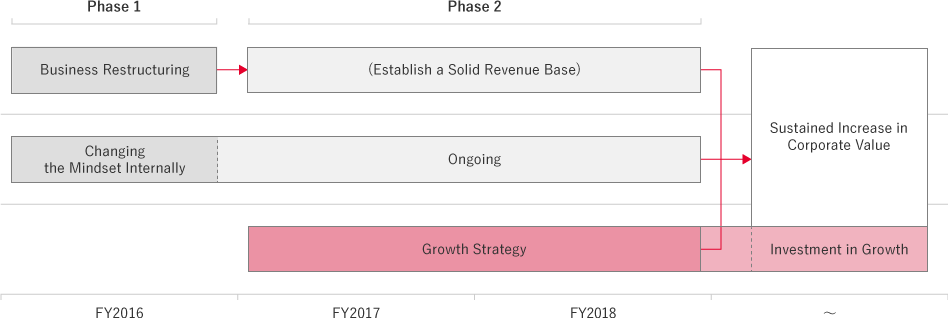

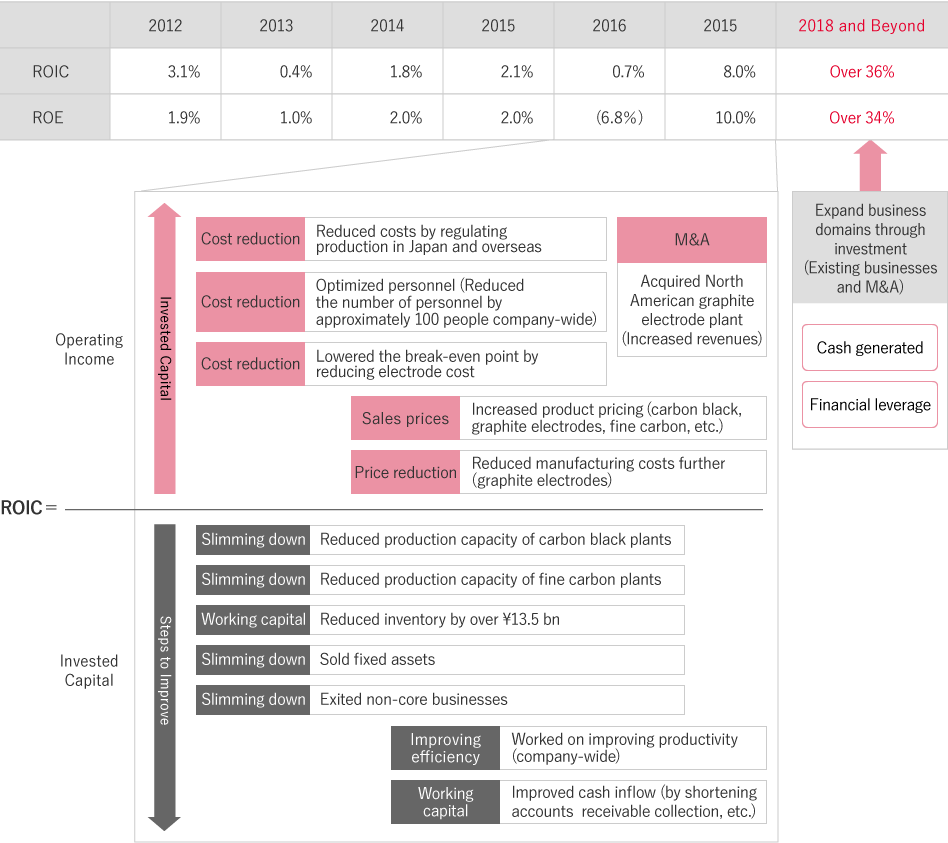

T-2018 sets management policies for the three-year period from 2016 to 2018. This three-year period is divided into two phases. In Phase 1 in 2016, the first year of the plan, Tokai Carbon implemented structural reforms. In Phase 2, running from 2017 to 2018, the company went forward with its growth strategy.

- Phase 1 (FY2016)

- ・Implementation of structural reforms: business restructuring and changing the mindset internally

- ・Introduction of ROIC management: Enhanced capital efficiency and progress management of the Mid-Term Management Plan

- ・Maintaining fiscal health

- Phase 2 (FY2017-FY2018)

・Growth strategy: A growth plan after building the foundation

Scroll horizontally to view the whole table

| Key performance objectives for 2018 | (For reference)2015 Performance | |

|---|---|---|

| Sales | 110 billion | 104.9 billion |

| Operating Income | 9 billion | 4.1 billion |

| ROS | 8% or more | 3.9% |

| ROIC | 6% or more | 2.1% |

3. Status of progress on T-2018 (as of August 10, 2018)

(1) Numerical targets and business forcast

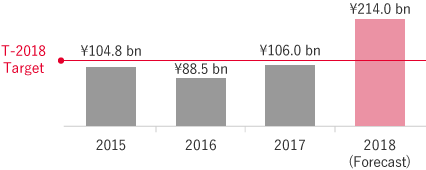

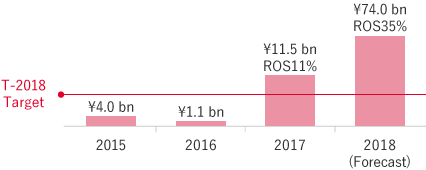

We have set a target of Sales \110.0 billion, Operating income \9.0 billion, ROS 8%, ROIC 6% in 2018, the final year of the Mid-Term Management Plan. Today, we achieved most of these targets already in 2017 year end. We anticipate 2018 results to be at much higher level.

Both net sales and operating income are projected to substantially exceed the targets.

Scroll horizontally to view the whole table

| T-2018 targets | Results & forecasts | |

|---|---|---|

| Sales |

|

|

| Operating income |

|

|

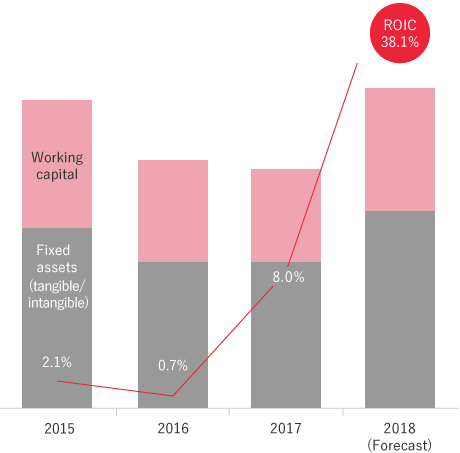

ROIC Target of 6% achieved early

- Reduce inventory By ¥13.5 billion for all segments (FY2016)

- Reduce fixed assets

Reduce fine carbon production capacity

Reduce carbon black production capacity

Sell idle assets of Tokai Konetsu Kogyo Co., Ltd.

Sell Nagoya Green Club land

Impairment losses of roughly ¥10 billion in main business segments (FY 2016)

(2) Phase 1 Business Restructuring

During the first year, FY2016 (Phase 1), Tokai Carbon engaged with all the issues assumed by the plan and almost all the plan goals were achieved. The size of the issues that had built up within the company over the years was even greater than had been anticipated. The company is currently booking over ¥10.0 billion in impairment losses for the period and in the end was left with no choice but to post record-setting losses. Nevertheless, the plan has resulted in an improvement in the company’s business condition and we were able to streamline the organization to make it profitable.

Business restructuring

Undertook and implemented all the initially scheduled action plans

| Item | Measures | Results |

|---|---|---|

| i. Optimization of carbon black manufacturing plants | Close one line at Tokai Carbon (Tianjin) Co., Ltd. |

|

| Close one line at the Ishinomaki Plant | Reduced production capacity by roughly 20% | |

| ii. Structural reforms in the Fine Carbon business | Reduce isotropic graphite production capacity | Reduced production capacity by roughly 45% |

| Streamline product line-up |

|

|

| iii. Optimization of personnel | Offer voluntary retirement for those desiring it, and take other steps | Reduced the number of personnel by approximately 100 people company-wide |

| iv. Initiatives to address industry restructuring in the Graphite Electrodes business | ||

| v. Asset reduction | Reduce inventory | Reduced inventory by more than ¥13.0 bn |

|

|

|

(3) Phase 1: Changing the mindset internally

Tokai Carbon has implemented a range of strategies to change the mindset internally. We believe the reforms that we have implemented in the decision-making process for business decisions, the human resources exchanges fostered between business segments, and the use of outside human resources have been even more effective than anticipated. We are planning to continue these initiatives. Reforming the mindset internally and further improvements to our technical capabilities involve matters of corporate culture. This is not something that can be done overnight. We will continue our strong engagement with these important issues throughout the remainder of T-2018.

Changing the mindset internally

Implemented various measures. Will continue to work on initiatives for the remainder of T-2018

| Item | Measures | Results |

|---|---|---|

| i. Energizing human capital | Implement human resources exchanges between business segments | Engaged in exchanges for many GM positions at the business division level |

| Recruit human resources from outside the company | Extended offers to seven people in total General Affairs/Public Relations, Accounting, Production Control, Engineering, anode material |

|

| ii. Reinstating the right to claim “Tokai, an expert in technologies” | Expand the Technology Division |

|

| iii. Strengthening the corporate division |

|

|

| iv. Other | Engage in internal PR to change mindsets internally | Distributed messages from the president internally |

(4) Phase 2 Growth Strategy

In 2016, we focus our efforts on structural reform to build a firm foundation for growth. In 2017 and beyond, we will deploy strategies for growth based on a new foundation consisting of the business restructuring completed in Phase 1 and ongoing efforts to change the mindset internally. Each of the business segments is deploying policies according to their respective potential markets to (1) improve profitability and (2) expand business domains toward the development of policies for our growth strategy. The third approach, (3) mergers and acquisitions, will give due consideration to peripheral business domains regardless of Tokai Carbon’s existing business domains. We will optimize our business portfolio and enlarge the company scale in view of the mid- and long-term.

Measures suitable for the external environment and potential market for each business segment

- (1) Improve profitability

-

- Graphite Electrodes Business Reduce manufacturing costs and SG&A expenses more

- Fine Carbon Business Complete execution of structural reform plan

- (2) Expand business domains

-

- Carbon Black BusinessExpand market sales of high value-added products

- Tokai Konetsu Kogyo Co., Ltd.Expand sales of industrial furnaces

Expand sales of heating elements - Friction Materials BusinessExpand sales

- New business growthLiB anode material, aqueous carbon black, next generation

- (3) M&A

-

- Existing business domains

- Expand business segments to include electronic components and automotive-related products

4. Toward T-2018

In the process of the structural forms of T-2018, we had no choice but to slim down our business. In the last phase of T-2018, however, we will be sowing the seeds of a growth strategy. Our efforts will be to ensure steady growth after T-2018. We aim to increase the scale of our business over the mid- to long-term, and toward that end we have set a strategic investment budget of ¥50 billion. This strategic budget allow us the Acquisition of shares in SGL GE Carbon Holding LLC (November 2017) and Tokai Carbon Korea Co., Ltd.(May 2018) that now joined Tokai Carbon Group. Further on, we are now in a process to close the deal of acquiring Sid Ricahrdson Carbon , Ltd (completion of acquisition expected September 2018). The series of these business decision are to stabilize our business portfolio and to expand our business domains.

Shrink :

During the Mid-Term Management Plan, structural reforms were undertaken

which led to constitutional change by improving ROIC.

Grow :

In 2018 and beyond, we will focus on expanding our business domains with the cash generated from

our core business and through financial leverage.

Scroll horizontally to view the whole table

5. Latest performance forecast (As of August 10, 2018)

(Millions of yen)Scroll horizontally to view the whole table

| T-2018 Target (For reference) |

2015 | 2016 | 2017 | 2018(Forecast) | |

|---|---|---|---|---|---|

| Net Sales | 110,000 | 104,864 | 88,580 | 100,000 | 214,000 |

| Operating Income | 9,000 | 4,088 | 1,131 | 10,500 | 74,000 |

| Net Income Attributable to Owners of the Parent Company |

- | 2,484 | (7,929) | 10,800 | 74,000 |

| ROS | 8% or higher | 3.9% | 1.3% | 10.5% | 34.6% |

| ROE | - | 2.0% | (6.8%) | 9.3% | 51.4% |

| ROIC | 6% or higher | 2.1% | 0.7% | 8.1% | 38.1% |

| Depreciation and Amortization | - | 9,242 | 8,124 | 6,500 | 7,500 |

| Capital Investment | - | 5,301 | 6,013 | 4,500 | 17,000 |

| Inventory | - | 34,253 | 20,734 | - | 45,000 |

| Tangible and Intangible Fixed Assets |

- | 96,106 | 81,178 | - | 106,000 |